Aaron's Cryptocurrency Primer

I had to google the word "primer" to make sure it actually means what I thought it means. The definition is "a short informative piece of writing," but I have a feeling this won't be so short. I'll try to keep it easy to understand though.

So what is cryptocurrency exactly?

Most people have heard about Bitcoin or even cryptocurrency, but it's not easy to find a simple definition of what it is. Its main goal, in most cases, is really the same as regular currency (gold, cash, etc) - to transfer value, but built into it is the ability to guarantee the validity of ownership. Currently, banks & credit card companies are largely responsible for doing that; they keep a ledger of who owns what and handle transferring money from person to person. At the core of most cryptocurrency is open source code, meaning anyone can view or contribute to it, which does a bunch of crazy complex stuff to make guarantee authenticity and provide security.

Bitcoin is just the first established cryptocurrency to make it into the mainstream. There are now thousands of other currencies, or "coins". If you care to dive a little deeper into how it all works, this is a great (26min) video that describes it in an easy to understand way. I'd recommend this if you just want to watch one video that gives you just the right level of overview.

That's my novice understanding of it anyway, although apparently, it also makes Even Smart People Feel Dumb. Ultimately this technology is like a new born baby; it still has a lot of growing up to do. Since it's so easy for people to publish their opinions, as I am doing, there are a lot of "experts" out there who really don't know much more than you or I do.

What are the implications of all this?

I'll start by sharing some examples of what cryptocurrency is already doing in society at large.

- Enabling oppressed societies to store & transfer wealth to avoid government corruption (can't find link)

- Allow corrupt people to do the same things on black markets

- Basic international commerce while avoiding middlemen's fees (like credit card companies)

There are obviously pros and cons of all of this. As my high school technology teacher once said, "Every new technology introduces new problems." Hopefully, the good use cases will outweigh the drawbacks of some of the negative ones.

The crazy thing is that since it's still so early on, we might only be seeing the tip of the iceberg. When computers came around, few were able to envision being able to stay in touch with friends across the world (Facebook), access the world's encyclopedia (Wikipedia), buy nearly anything you need and have it shipped in a day (Amazon). Optimists feel cryptocurrency could bring similar innovations to the world, while pessimists view it as nothing more than a mere novelty.

What is Mining?

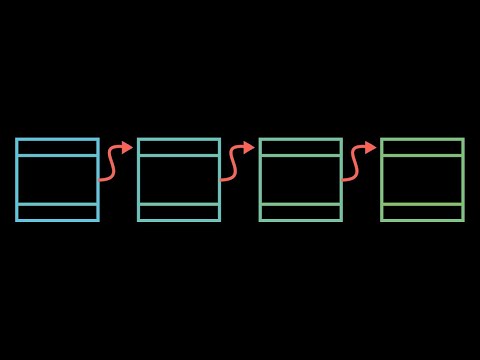

I don't believe understanding mining is necessary to have a broad understanding of cryptocurrency, but it is one area that my friends and I are particularly interested. Basically, you buy and put together computer parts that are particularly good at running the complex math needed to verify and facilitate cryptocurrencies' transactions. Graphics cards are really good at this kind of math, so it's like building a regular computer but with all the power focused on GPUs. Hobbyist "rigs" typically range anywhere from ~$600-4000. Built into the code of these currencies is logic that basically rewards people who run these computations with portions of the currency they are mining.

During the peak of the craze, you could spend $1700 on a rig that could make you nearly that much every month. However, the more people that are mining means less of the computations to go around, so the difficulty number goes up, which means you make less money. We happened to get into it on the other side of the peak, so it might be close to a year or more that we make our money back, depending on what prices of these currencies do. It's generally not recommended to get into unless you enjoy learning about how all these pieces fit together and are willing to get your hands dirty, especially at this point.

There are also specialized ASICs (application-specific integrated circuits), or basically, computer hardware manufactured just used for mining a specific currency which produces a much higher rate of return but can take businesses years and hundreds of thousands of dollars to create. Sometimes they sell these to hobbyist to use, but it's generally in their best interest to just mine with them themselves until it's less lucrative, then sell them off.

Other cryptocurrencies I am personally interested in

Like I said, there are thousands of other cryptocurrencies. I could even make my own Mead Coin. What typically turns them into something people care about is when they are listed on an exchange where you can trade it for other currencies. We have obviously been in a bit of a bubble, just like the dot com bubble early in the 2000s, where there have been illegitimate currencies and "ICOs," like an IPO but for a cryptocurrency, that have either been outright scams or just a currency with no real value. I tend to avoid these because I know I don't know enough to discern the legitimate ones.

Just like with stocks, don't invest money you can't afford to lose. This is especially true in these markets where there is essentially no regulation. My personal interest is basically spreading a bit of money across a wide range of currencies that are super early in the hopes that just one explodes in value. It's likely safer to just put some money in something like Ethereum which seems likely to at least double in the coming years, but it already has a market cap of $27 BILLION dollars at the time of writing this. As a side note, market cap means the same thing as is it does in the public markets, but it remains to be seen what principles from public markets apply in these.

So all that being said, here are some coins that seem to have some potential and real value behind them to me. I'll include prices on the day of writing this (8/13/2017), and basic information about how they work. I've "invested" a couple hundred bucks spread out through some of these.

- Siacoin: ($0.0075/coin, $216m cap) - You know iCloud, Dropbox, etc? Siacoin basically does the same thing but for a lower cost because it allows anyone to run their network. Bits of your files get stored across different systems and put back together when you need to retrieve them. This also allows people to make money by opening up space on their computers to host said bit of files.

- Basic Attention Token: ($0.20/coin, $202m cap) - The goal is to provide content creators (bloggers, media sites, etc) the ability to make money without having to litter their content with ads. Users who sign up and commit a certain number of BAT to be spent on sites they browse the longest to be given to those content creators. This is cool because I may not want to spend $9/mo on a NY Times membership but I wouldn't mind paying a quarter for an article I spent an hour reading, something currently impractical paying with a credit card.

- TaaS: ($3.44/coin, $28m cap) - Basically a mutual fund for cryptocurrencies. They have a team of "experts" who invest in other currencies. The cool aspect, that I think will become a more common model, is that every quarter I believe they pay out 50% of profits to shareholders with 25% going back to the team and 25% back into the fund. I don't have the time or expertize to research these new currencies, but allegedly at least, they do :).

- Steem ($1.24/coin, $296m cap) - Think of the website Reddit but where you can earn money for submitting upvoted content, or for curating content that others like.

- Golem ($0.29/coin, $239m cap) - Basically creates a supercomputer from all users running their network on their computers. Then, gives people access to run programs on the super computer, at hopefully a lower price than other offerings than ones from the big companies like IBM.

All of these will have two uphill battles, not only making good use of cryptocurrency technologies but creating a legitimate business behind them. They won't all succeed int he long term on hype alone, and they'll likely be competing with legitimate businesses that aren't also running a cryptocurrency as well.